If you’ve ever shopped at Pottery Barn, you know how tempting their furniture and home decor can be. So, it’s no wonder that many people wonder when Pottery Barn charges their credit cards.

The answer may vary depending on the type of purchase you make. If you buy an item that is in stock and available for immediate shipment, Pottery Barn will typically charge your credit card at the time of purchase. This means that the amount will be deducted from your account immediately, and you’ll receive a confirmation email with the details of your order.

On the other hand, if you make a pre-order or a backordered item, Pottery Barn may charge your credit card at a later date. This is because they wait until the item is available for shipment before processing the payment. You’ll still receive a confirmation email with the details of your order, but the charge will be pending until the item is ready to be shipped.

It’s important to keep in mind that each purchase may have different shipping times and payment processing procedures, so it’s always a good idea to review the terms and conditions before making a purchase at Pottery Barn. By understanding when they charge your credit card, you can better plan your budget and ensure a smooth shopping experience.

Payment Methods Accepted by Pottery Barn

Pottery Barn offers a variety of payment methods to make your shopping experience convenient and hassle-free. Whether you prefer to pay with a credit card, debit card, or electronic payment option, Pottery Barn has you covered.

Here are the payment methods accepted by Pottery Barn:

- Credit Cards: Pottery Barn accepts major credit cards such as Visa, Mastercard, American Express, and Discover. You can easily provide your card details during the checkout process and complete your purchase.

- Debit Cards: If you prefer to use a debit card, Pottery Barn accepts any debit card that is affiliated with Visa or Mastercard. Simply enter your card details and confirm your payment to complete your order.

- Gift Cards: Pottery Barn also accepts their own branded gift cards as a form of payment. If you have a Pottery Barn gift card, you can enter the card number and PIN during checkout to apply the balance towards your purchase.

- Pottery Barn Credit Card: If you are a frequent shopper at Pottery Barn, you may consider applying for their credit card. With a Pottery Barn credit card, you can enjoy exclusive benefits and rewards, as well as special financing options for larger purchases.

- Electronic Payment Options: Pottery Barn accepts electronic payment options such as PayPal and Apple Pay. If you have a PayPal account or prefer to use Apple Pay, simply select the appropriate option during the checkout process and follow the prompts to complete your payment.

Regardless of which payment method you choose, Pottery Barn makes it easy and secure to complete your purchase. Ensure that you have sufficient funds or credit available to cover your order total, and double-check your payment details before finalizing your transaction.

Understanding Pottery Barn’s Payment Schedule

Pottery Barn offers a variety of payment options to its customers, including credit card payments. If you choose to pay with a credit card, it’s important to understand Pottery Barn’s payment schedule to avoid any surprises or late fees.

When you make a purchase with Pottery Barn using a credit card, the company will typically charge your card immediately. This means that the total amount of your purchase will be deducted from your available credit or be added to your credit card balance right away.

If you have signed up for a Pottery Barn credit card, you may have the option to make monthly payments instead of paying the full balance at once. In this case, Pottery Barn will send you a monthly statement with a minimum payment due. The statement will outline your balance, any new charges, and the due date for payment.

It’s important to note that Pottery Barn may charge interest on any remaining balance if you don’t pay the full amount by the due date. The interest rate will vary depending on the terms of your credit card agreement. Late payments may also result in additional fees or penalties.

If you prefer to pay your Pottery Barn credit card balance in full each month, you can do so by making a payment online or by mail. Pottery Barn provides instructions on how to make payments on their website or in the monthly statement.

If you have any questions or concerns about Pottery Barn’s payment schedule or your credit card account, it’s best to contact their customer service department for assistance. They can provide you with specific information about your account and help address any issues you may have.

Pottery Barn’s Authorization Process

When you make a purchase on the Pottery Barn website, they will typically pre-authorize your credit card for the total amount of your order. This pre-authorization is a way for Pottery Barn to ensure that your credit card is valid and has enough funds to cover the purchase.

The pre-authorization hold on your credit card is not an actual charge, but it may temporarily reduce your available credit or bank balance until the pre-authorization is released. The duration of the hold can vary depending on your credit card issuer or bank, but it is usually released within a few business days.

After the pre-authorization is completed, Pottery Barn will process your order and prepare it for shipment. Once your order is shipped, Pottery Barn will then charge your credit card for the final amount of your purchase, including any applicable taxes and shipping fees.

If there are any issues with processing your payment or if an item in your order is unavailable, Pottery Barn may contact you to provide alternative payment options or to adjust your order accordingly. In such cases, the pre-authorization hold may be released, and a new pre-authorization may be placed on your credit card, depending on the circumstances.

It’s important to review your credit card statement or online account regularly to ensure that the charges from Pottery Barn are accurate and in line with your purchases. If you have any concerns or questions about the charges on your credit card, it’s recommended to contact Pottery Barn’s customer service for assistance.

The Timing of Pottery Barn’s Credit Card Charges

When you make a purchase at Pottery Barn using your credit card, the timing of when the charge will be applied to your card can vary. Pottery Barn generally processes credit card charges within a few days of the purchase. However, the exact timing may depend on various factors such as the processing speed of your credit card company and any potential delays in the verification process.

It’s important to note that while Pottery Barn may process the charge quickly, it may take some time for the charge to appear on your credit card statement. This delay can vary depending on your credit card company’s billing cycle and how quickly they update their records.

If you have concerns about when a Pottery Barn charge will be applied to your credit card, it’s best to contact their customer service team. They can provide you with more specific information about their billing process and any potential delays you may experience.

Remember to keep track of your purchases and check your credit card statements regularly to ensure that all charges are accurate. If you notice any discrepancies or unauthorized charges, contact your credit card company immediately to report the issue and protect yourself from fraud.

How to Check Your Pottery Barn Credit Card Statement

Checking your Pottery Barn credit card statement is an important step in managing your finances and ensuring that your payments are up to date. Here is a step-by-step guide on how to check your Pottery Barn credit card statement:

- Visit the Pottery Barn website. You can access the website using any internet browser on your computer or mobile device.

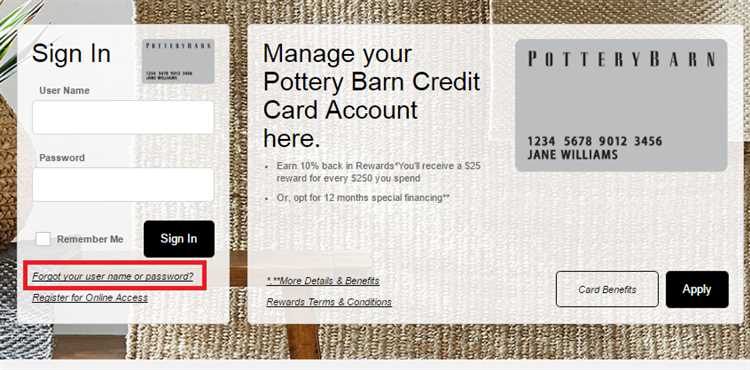

- Click on the “Sign In” button at the top right corner of the homepage. If you don’t have an account, you will need to create one.

- Enter your email address and password to sign in to your Pottery Barn account.

- Once you are signed in, navigate to the “My Account” section. This section is usually located in the top right corner of the webpage or in the dropdown menu under your username.

- In the “My Account” section, locate the “Credit Card” or “Manage Credit Card” option. Click on it.

- You will be redirected to a page where you can view your Pottery Barn credit card details and transactions. Look for the option to view your statement or recent transactions.

- Click on the statement or transaction link to access your Pottery Barn credit card statement. You may need to select the specific billing period you wish to view.

- Once you have selected the desired billing period, your Pottery Barn credit card statement will be displayed. Take the time to review the information, including your balance, due date, and any recent transactions.

- If you want to print or save a copy of your statement for your records, you can usually find an option to download or print the statement in a PDF format.

By following these simple steps, you can easily check your Pottery Barn credit card statement at any time and stay on top of your financial obligations.

What to Do If You Have a Payment Issue with Pottery Barn

If you have encountered a payment issue with Pottery Barn, there are several steps you can take to resolve the problem. Follow these steps to ensure a smooth and timely resolution:

- Contact Pottery Barn Customer Service: The first step is to reach out to the Pottery Barn customer service team. You can contact them via phone, email, or live chat. Provide them with all the relevant details of your payment issue, such as the date of the transaction, the amount charged, and any error messages you received.

- Keep Records: It’s important to keep records of all communication with Pottery Barn regarding your payment issue. Take note of the date and time of your interactions, the names of the customer service representatives you spoke to, and any reference or case numbers provided.

- Ask for a Resolution: Clearly explain the outcome you are seeking from Pottery Barn. Whether it’s a refund, a correction to the billing error, or any other resolution, make sure to convey your expectations to the customer service team.

- Follow Up: If you haven’t received a resolution within a reasonable timeframe, it’s essential to follow up with Pottery Barn. Politely inquire about the progress of your case and request a timeline for when the issue will be resolved.

- Escalate the Issue: If Pottery Barn fails to address your payment issue or provide a satisfactory resolution, you may need to escalate the matter. Ask to speak with a supervisor or request to be transferred to a higher level of customer service. Alternatively, you can inquire about the company’s dispute resolution process.

- Contact Your Credit Card Provider: If all else fails and Pottery Barn is unable or unwilling to resolve the payment issue, consider contacting your credit card provider. Explain the situation and provide them with any documentation or evidence you have gathered. They may be able to assist you in disputing the charge or providing a chargeback.

Remember to remain calm and patient throughout the process. Keeping a record of your communications and following up diligently will increase the chances of a swift resolution to your payment issue with Pottery Barn.

Frequently Asked Questions about Pottery Barn Credit Card Payments

1. When is my Pottery Barn credit card payment due?

Your Pottery Barn credit card payment is typically due on the same day each month. The due date will be stated on your monthly statement, and you can also find it by logging into your online account.

2. Can I make a payment online?

Yes, Pottery Barn offers online payment options for your credit card. You can log into your account on the Pottery Barn website and navigate to the payments section to make a payment.

3. Can I set up automatic payments for my Pottery Barn credit card?

Yes, you can set up automatic payments for your Pottery Barn credit card. This allows your payment to be automatically deducted from your chosen bank account on the due date each month. You can set up automatic payments through your online account.

4. What forms of payment does Pottery Barn accept?

Pottery Barn accepts various forms of payment for credit card payments, including debit cards, electronic checks, and bank account transfers. You can also make payments by mail with a personal check or money order.

5. Will I be charged a fee for using a credit card to make a payment?

No, Pottery Barn does not charge a fee for using a credit card to make a payment.

6. What happens if I miss a payment?

If you miss a payment on your Pottery Barn credit card, you may be subject to late fees and interest charges. It is important to make your payments on time to avoid these additional charges.

7. How long does it take for my payment to be processed?

The processing time for your Pottery Barn credit card payment can vary depending on the payment method you choose. Payments made online or by phone generally process within 1-2 business days, while payments made by mail may take longer to process.

8. Can I pay my Pottery Barn credit card bill at a store?

No, Pottery Barn credit card payments cannot be made in stores. Payments must be made online, by phone, or by mail.

9. Can I pay more than the minimum payment?

Yes, you can pay more than the minimum payment on your Pottery Barn credit card. Paying more than the minimum can help you pay off your balance faster and reduce the amount of interest you accrue.

10. Can I see my payment history online?

Yes, you can view your payment history online by logging into your Pottery Barn credit card account. Your payment history will show the date, amount, and method of each payment you have made.

11. Can I change my payment due date?

Unfortunately, you cannot change your Pottery Barn credit card payment due date. The due date is set at the time of account opening and remains the same throughout the life of the account.+

Tips for Managing Your Pottery Barn Credit Card Payments

Managing your Pottery Barn credit card payments is essential to ensure you maintain a good credit score and avoid unnecessary fees or penalties. Here are some tips to help you navigate the process:

- Set Up Automatic Payments: Pottery Barn offers the option to set up automatic payments for your credit card. This feature allows you to schedule regular payments to be deducted from your bank account automatically, ensuring you never miss a payment.

- Pay on Time: Make sure to pay your Pottery Barn credit card bill on time to avoid late fees and penalties. Set reminders or establish a routine to ensure you stay organized and never miss a payment.

- Pay More Than the Minimum: While making the minimum payment may help you avoid late fees, it’s important to pay more than the minimum amount due whenever possible. This will help you pay off your balance faster and reduce interest charges.

- Track Your Spending: Regularly monitor your credit card statements and track your spending to ensure you stay within your budget. This will help you avoid overspending and accumulating too much debt.

- Consider a Balance Transfer: If you’re struggling to pay off your Pottery Barn credit card balance, you may want to explore the option of a balance transfer. This involves transferring your debt to a credit card with a lower interest rate, potentially saving you money in the long run.

- Avoid Cash Advances: Cash advances on your Pottery Barn credit card often come with high fees and interest rates. It’s best to avoid using your credit card for cash advances whenever possible to minimize unnecessary costs.

- Monitor Your Credit Score: Regularly check your credit score to ensure it remains in good standing. This will help you identify any discrepancies or errors and take necessary actions to resolve them.

By following these tips, you can effectively manage your Pottery Barn credit card payments and maintain a healthy financial situation.

FAQ:

When will Pottery Barn charge my credit card for my online order?

Pottery Barn will charge your credit card for your online order as soon as the items are shipped from their warehouse.

Can Pottery Barn charge my credit card before shipping the items?

Yes, Pottery Barn may charge your credit card before shipping the items if the total amount is above a certain threshold or if the items are made to order.

What happens if my credit card is declined when Pottery Barn tries to charge it?

If your credit card is declined when Pottery Barn tries to charge it, they will contact you to request an alternative payment method. If they are unable to reach you or if you fail to provide a valid payment method within a certain timeframe, your order may be canceled.

Can I cancel my order after Pottery Barn has charged my credit card?

Yes, you can cancel your order after Pottery Barn has charged your credit card. However, you may be subject to a cancellation fee or other charges depending on the specific circumstances.